Tenant Sanctions Checks: How New UK Regulations Will Affect Rental Applications

From 14th May 2025, tenant sanctions checks will become a formal part of the UK rental process. Under updated financial sanctions regulations, letting agents must screen all prospective tenants against the UK Sanctions List before a tenancy can proceed.

This change applies to every applicant—UK residents and overseas arrivals alike. For many, the process will feel similar to Right to Rent checks. But this time, it’s not about immigration—it’s about financial compliance and legal obligations.

Let’s break down what this means and what you’ll need to prepare.

Redundancy Planning: How Global Mobility Supports HR Teams

Redundancy planning is a complex process that requires careful coordination and sensitivity. HR teams must balance legal compliance, employee well-being, and business continuity. Global mobility plays a crucial role in managing redundancies, offering solutions such as redeployment, repatriation, and structured outplacement support.

A well-executed redundancy strategy, incorporating global mobility, ensures affected employees receive guidance while minimising disruption for the organisation. Below, we explore key ways HR teams can leverage global mobility during redundancy planning.

Energy-Efficient Living: Reduce Environmental Impact

Energy-efficient living is essential for reducing environmental impact and lowering energy costs. By adopting sustainable practices, individuals can make a significant difference in their carbon footprint and household expenses. From optimising heating systems to choosing energy-efficient appliances, there are many ways to incorporate energy-saving habits into daily life. This guide provides practical steps for reducing energy consumption and creating an eco-friendly home.

Real Estate and Climate Impact: Promoting Energy Efficiency

Real estate and climate impact are increasingly linked as the real estate sector contributes significantly to global emissions. For employees relocating to the UK, understanding how buildings affect the environment and how to use energy more efficiently is important in today’s climate. As the sector accounts for 40% of global greenhouse gas emissions, it’s essential to adopt practices that reduce energy consumption. This approach benefits both the environment and individuals’ day-to-day lives, making relocation efforts more sustainable.

UK Investment: Driving Global Mobility and Employee Relocation

UK investment is attracting unprecedented attention from global business leaders. Recently ranked as the second most desirable destination for foreign investment, after the United States, the UK has solidified its position as a global economic powerhouse. This ranking highlights the UK’s evolving economic landscape and its expanding influence on the international stage. For businesses looking to expand, the UK’s stability and innovation make it a standout choice. This surge in investment also significantly impacts global mobility and employee relocation, reshaping the movement of talent and resources worldwide.

UK Housing Costs: A Guide for Indian Professionals

UK housing costs can present a surprising challenge for Indian professionals moving to the UK. While the relocation may promise career growth and new opportunities, adjusting to the realities of the UK housing market can feel like an unexpected hurdle, especially for those used to Indian housing costs and standards. When assisting relocating professionals, we frequently see how initial expectations about rent and living standards don’t align with the realities in high-demand UK cities. This guide is designed to bring clarity, helping you understand the differences in housing expenses and prepare effectively for your move.

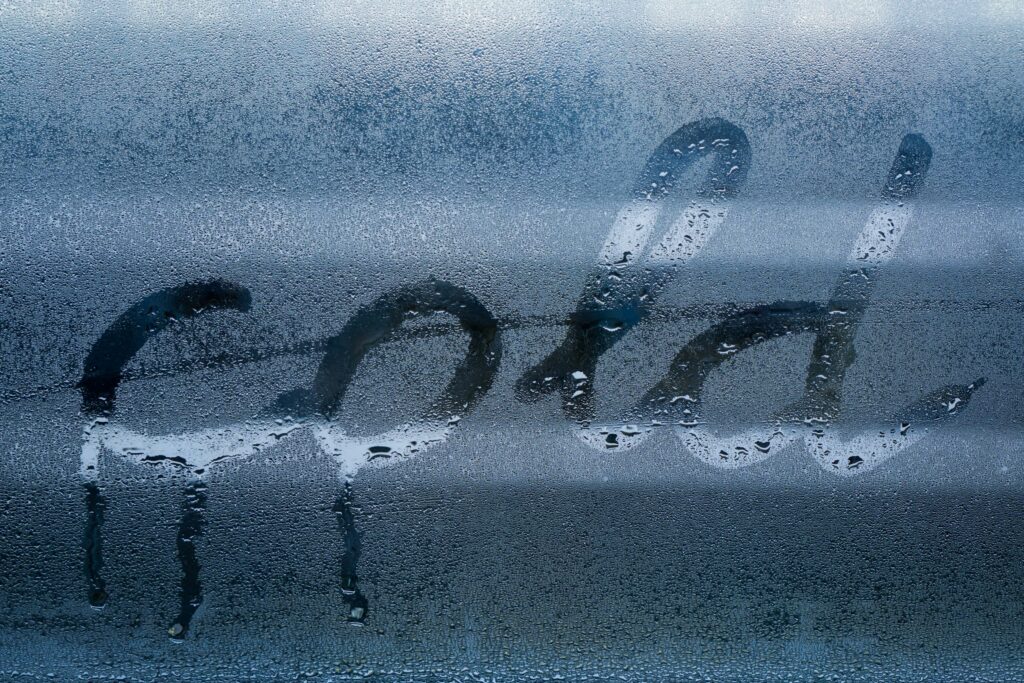

Condensation Clauses in UK Tenancy Agreements

Condensation clauses are common in UK tenancy agreements, reflecting the country’s humid climate, frequent rain, and older housing stock. These clauses outline tenants’ responsibilities in preventing condensation, which, if unmanaged, can lead to damp, mould, and property damage. For relocating employees, understanding these clauses is essential for a comfortable tenancy and to avoid potential disputes.

Typically, condensation clauses specify steps tenants should take, such as ventilating and heating the property effectively. This guide is designed to help new arrivals and HR teams overseeing employee relocations understand the purpose of these clauses, the responsibilities they entail, and how landlords and tenants are legally expected to address condensation issues. With this knowledge, tenants can avoid complications, uphold tenancy terms, and enjoy a healthy living environment.

Council Tax: What Expats Need to Know

Council Tax (known as Rates in Northern Ireland) is one of the first expenses expats must understand when relocating to the UK. It funds essential local services and varies depending on where you live, making it an important aspect of your new life to get right from the start. This guide will explain what Council Tax is, how it’s calculated, and the differences across the UK’s nations. Whether you’re moving to England, Scotland, Wales, or Northern Ireland, this overview will help you manage this tax efficiently and avoid unnecessary surprises.

Rental Income Requirements in the UK

Rental income requirements are an important part of the process when renting a property in the UK. It’s not just about finding a flat or house that suits your style or location preferences; landlords and letting agents also want to know whether you can comfortably afford the rent. As you begin your search, you’ll quickly realise that securing a rental property involves meeting specific financial criteria, which can vary based on the location and the type of property.

Understanding the financial requirements upfront is essential, as these criteria ensure that tenants can manage the rent without stretching their finances too thin. From the income-to-rent ratio to additional living costs like utilities, knowing what to expect can help you prepare more effectively and avoid any surprises. With a competitive rental market in many parts of the UK, being aware of these factors can put you in a stronger position and help ensure a smoother renting experience.

Harmonising Economics and Employee Satisfaction: Creating Cost-Effective Relocation Packages

Employees may find that relocating for a job opportunity is both exciting and daunting. It marks the start of a new professional and personal chapter, often involving uprooting one’s life and settling into unfamiliar territory. For companies, offering relocation packages is a valuable tool for attracting top talent from across the globe. However, crafting a competitive relocation package while adhering to budgetary constraints poses a significant challenge for employers. In this article, we explore the delicate balance between meeting the needs of employees and the financial limitations of companies when it comes to relocation packages.

How Can Expats and Digital Nomads Survive the Cost-of-Living Crisis in 2022?

Expats around the world are already starting to experience the worst cost-of-living crisis in a generation, with budgets squeezed by tax rises and everyday purchases going up in price. The biggest change for most expats has been the increase in the energy cap on April 1, but many other price rises will add hundreds of pounds to an expat’s household spending too. The net result of rising inflation could leave thousands of expats worse off this year.